Revenue vs. Recognition – What’s the Difference?

Do you know the difference between revenue and recognition? Constituent revenue includes only those commitments and payments that were made personally by that constituent, and as a result, the Revenue Summary and Revenue History tabs exclude some important gifts. The complete view of a donor’s giving history is found in their Recognition Summary and Recognition History tabs. This is where you’ll see, in addition to personal gifts, any gifts made by a spouse or through a third-party such as a DAF, personal business, private foundation, or matching gift company. If you have any questions about revenue and recognition, contact Gift Accounting at 542-4438 (542-GIFT).

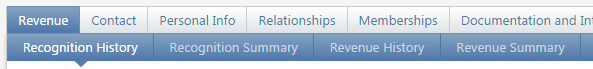

Helpful Hint: All tabs and second tier tabs can be rearranged as in the example above. Simply drag and drop each tab in the order of your preference and this option will remain sticky.